The British currency is the pound sterling. The sign for the pound is GBP = Great British Pound We do not use the Euro. Before you arrive in the United Kingdom, it's a good idea to familiarize yourself with the local currency. The official currency of England, Wales, Scotland and Northern Ireland is the pound sterling (£), often abbreviated to GBP. Currency in the UK remains unchanged by the European referendum of 2017. Our currency converter calculator will convert your money based on current values from around the world.

The pound sterling is the oldest currency in the world that is still in use. What do you know about the money used in the UK?

Do the Preparation task first. Then watch the video or listen to the audio. Next go to Task and do the activity. If you need help, you can read the Transcript at any time.

We suggest you do the vocabulary activity below before you watch. Then watch the video and after that, do the tasks to check your comprehension. You can read the transcript at any time if you want to.

Currency

Although the UK is in the European Union, it has taken the decision at the moment not to adopt the Euro as its currency. Instead it retains pound sterling.

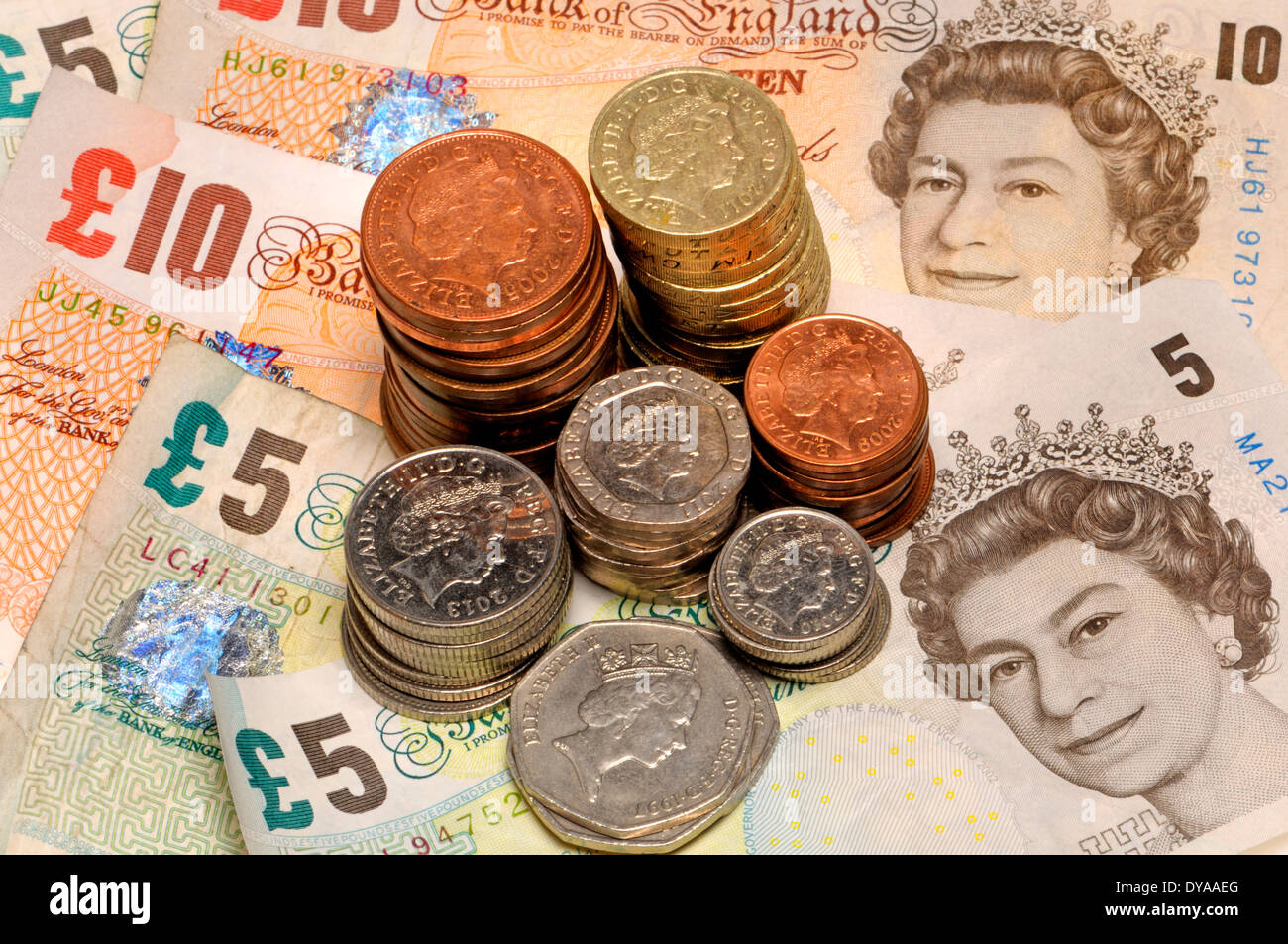

A pound consists of 100 pence. The word ‘pence’ being very often shortened to the letter ‘p’ in both the written and in conversational form.

The following coins are in regular circulation:

- 1p

- 2p

- 5p

- 10p

- 20p

- 50p

- £1

- £2

The following notes are also used:

- £5

- £10

- £20

- £50

These notes are usually issued in the name of the Bank of England and the notes and coins are accepted throughout the UK. You may occasionally find some bank notes bearing the names of Banks in Scotland or Northern Ireland, like the Scottish notes shown here. These are still legal tender throughout the UK but some traders, because they are not familiar with them, may be reluctant to accept them outside of the country in which they were issued. If you do have any difficulties though, any Bank will replace them without charge.

Task 1

Read the questions and select the right answer.

Task 2

Read the sentences and fill in the gaps by dragging the words from the top.

Discussion

Is currency important for a country’s identity?

Do you think the introduction of the Euro was a positive move?

Language level

- Log in or register to post comments

The British Pound is the currency of United Kingdom. Our currency rankings show that the most popular United Kingdom Pound exchange rate is the GBP to EUR rate. The currency code for Pounds is GBP, and the currency symbol is £. Below, you'll find British Pound rates and a currency converter. You can also subscribe to our currency newsletters with daily rates and analysis, read the XE Currency Blog, or take GBP rates on the go with our XE Currency Apps and website. More info ►

Top GBP Exchange Rates

Currency Facts

Name: British Pound

Symbol: £ penny: p

Minor Unit:

1/100 = penny

Central Bank Rate: 0.75

Top GBP Conversion:

GBP/EUR

Top GBP Chart:

GBP/EUR Chart

Inflation: 2.70%

Nicknames:Pound Sterling, Sterling, Quid, Nicker

Coins:

Freq Used: £1, £2, 1p, 2p, 5p, 10p, 20p, 50p

Banknotes:

Freq Used: £5, £10, £20, £50

Rarely Used: £100

British Currency Bob

Central Bank:

Bank of England

Website: http://www.bankofengland.co.uk

:max_bytes(150000):strip_icc()/man-with-banknotes-in-his-pocket-80993279-5af38c30119fa800371cb8bd.jpg)

Users: United Kingdom (UK), England, Northern Ireland, more ...

Have more info about the British Pound?Email us ►

XE Currency Converter

British Currency Calculator

Why are you interested in the GBP?

British Pound History

The United Kingdom's central bank is the Bank of England. As the fourth most traded currency, the British Pound is the third most held reserve currency in the world. Common names for the British Pound include the Pound Sterling, Sterling, Quid, Cable, and Nicker.

Importance of the British Pound

The British Pound is the oldest currency still in use today, as well as one of the most commonly converted currencies. The Falkland Islands, Gibraltar, and Saint Helena are all pegged at par to the GBP.

Early Currency in Britain

With its origins dating back to the year 760, the Pound Sterling was first introduced as the silver penny, which spread across the Anglo-Saxon kingdoms. In 1158, the design was changed and rather than pure silver the new coins were struck from 92.5% silver and became to be known as the Sterling Pound. Silver pennies were the sole coinage used in England until the shilling was introduced in 1487 and the pound, two years later, in 1489.

British Pound Notes and the Gold Standard

The first paper notes were introduced in 1694, with their legal basis being switched from silver to gold. The Bank of England, one of the first central banks in the world, was established a year later, in 1695. All Sterling notes were handwritten until 1855, when the bank began to print whole notes. In the early 20th century, more countries began to tie their currencies to gold. A gold standard was created, which allowed conversion between different countries' currencies and revolutionized trading and the international economy. Great Britain officially adopted the gold standard in 1816, though it had been using the system since 1670. The strength of the Sterling that came with the gold standard led to a period of major economic growth in Britain until 1914.

The British Pound and the Sterling Area

The British Pound was not only used in Great Britain, but also circulated through the colonies of the British Empire. The countries that used the Pound became to be known as the Sterling Area and the Pound grew to be globally popular, held as a reserve currency in many central banks. However, as the British economy started to decline the US Dollar grew in dominance. In 1940, the Pound was pegged to the US Dollar at a rate of 1 Pound to $4.03 US Dollars and many other countries followed, by pegging their respective currencies. In 1949, the Pound was devalued by 30% and a second devaluation followed in 1967. When the British Pound was decimalized and began to float freely in the market, in 1971, the Sterling Area was terminated. Following, the British Pound experienced a number of highs and lows.

- 1976: A sterling crisis arose and the UK turned to the International Monetary Fund for a loan

- 1988: The GBP started to shadow the Deutsche Mark

- 1990: The UK joined the European Exchange Rate Mechanism, though withdrew from it two years later

- 1997: The control of interest rates became the responsibility of the Bank of England